This analysis report, backed by quality data, covers the major developments the Web3, Blockchain, and Crypto sectors have experienced this week.

1. Jaunākās ziņas šonedēļ

- Apple’s Mac Security Vulnerability Exposed

A critical flaw in Apple’s M-series chips poses a risk to users’ cryptographic private keys. Researchers suggest a workaround, but it may significantly impact device performance, highlighting the urgent need for a direct resolution to safeguard user data.

- Hackers Launder Funds Through Tornado Cash

Despite sanctions, hackers continue to move stolen assets, totaling $145.7 million, through Tornado Cash. The platform’s role in obscuring fund ownership raises concerns, emphasising the ongoing challenges in tracking illicit cryptocurrency transactions.

- Google Adds ENS Support for Ethereum Wallets

Google extends support to display Ethereum wallet balances using Ethereum Name Service (ENS) domains. This integration streamlines cryptocurrency transactions by replacing complex wallet addresses with human-readable domains, enhancing accessibility and usability for users engaging with Ethereum-based assets.

- Blockchain Game Exploited Before Launch

Exploitation of a smart contract bug led to a $4.6 million loss for Super Sushi Samurai just before its anticipated launch. This incident underscore the importance of rigorous smart contract auditing and testing to mitigate vulnerabilities and safeguard user funds in blockchain-based applications.

- OKX To Halt Services in India

OKX announces the cessation of services in India, citing regulatory concerns. This move follows a broader trend of regulatory crackdown on cryptocurrency exchanges by governments around the world.

- Tornado Cash Developer Accused of Money Laundering

Alexey Pertsev faces accusations of laundering $1.2 billion through Tornado Cash, despite denying involvement in breaching money laundering laws. The indictment from the Netherlands alleges over 30 illegal transactions on the platform.

- Binance Founder Launches Education Project

Former Binance CEO, Changpeng Zhao, initiates a non-revenue, free education project targeting underprivileged children in developing countries. This philanthropic effort aims to bridge educational gaps and empower marginalised communities through access to knowledge and opportunities in emerging technologies.

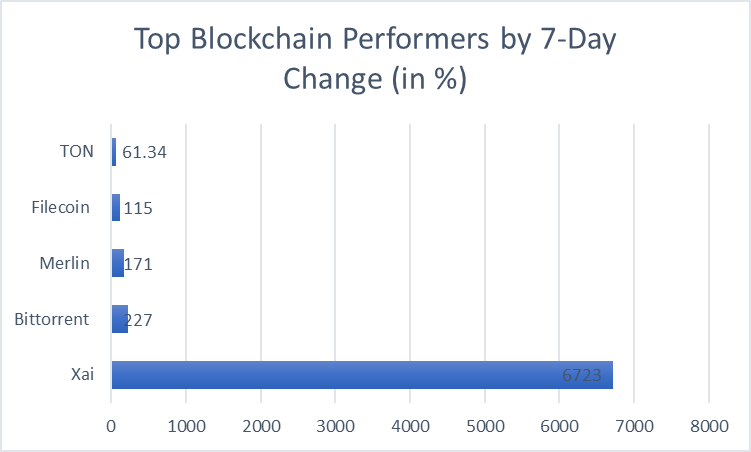

2. Blockchain Performance

Šajā sadaļā mēs galvenokārt analizēsim divus faktorus: vislabākās veiktspējas blokķēdes, kuru pamatā ir tikai to 7 dienu izmaiņas, un labāko veiktspēju starp piecām labākajām blokķēdēm ar augstāko TVL.

2.1. Labākie blokķēdes izpildītāji pēc 7 dienu izmaiņām

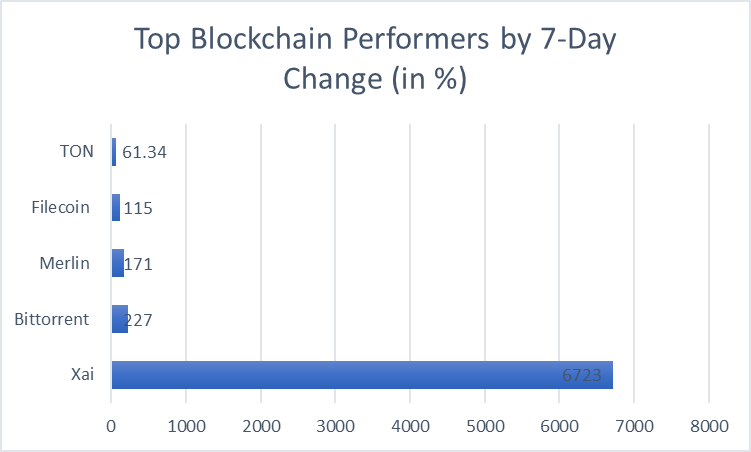

This week’s top blockchain performers, based on their 7-day change, are Xai, Bittorrent, Merlin, Filecoin, and TON.

| Blockchain | 7 dienu izmaiņas (%) | TVL |

| Xai | 6723% | $931,142 |

| Bittorrent | + 227% | $ 1.1M |

| Medību piekūns | + 171% | $ 38.49M |

| Filecoin | + 115% | $ 39.21M |

| TON | + 61.34% | $ 72.05M |

Among the top blockchain performers by 7-day change, Xai leads with an impressive 6723% increase, indicating significant market activity. Bittorrent follows with a substantial 227% growth, while Merlin, Filecoin, and TON also demonstrate notable uptrends.

2.2. Labākie izpildītāji: 7 dienu izmaiņas top 5 blokķēdes ar augstāko TVL

Ethereum, TRON, BNB Smart Chain, Solana un Arbitrum One ir piecas labākās blokķēdes tirgū, pamatojoties uz TVL un dominējošo stāvokli tirgū. Apskatīsim, kā šonedēļ ir veicies piecām labākajām blokķēdēm, izmantojot 7 dienu TVL maiņu.

| Blockchain | 7 d izmaiņas (%) | Dominēšana (%) | TVL (miljardos) |

| Ethereum | -8.23% | 61.19% | $ 48.497B |

| TRON | -5.37% | 11.18% | 9.505B |

| BNB viedā ķēde | -4.17% | 7.07% | 5.594B |

| Solana | -5.03% | 4.83% | $ 3.954B |

| Arbitrum One | -5.88% | 4.63% | $ 3.159B |

| pārējie | 11.10% |

Among the top 5 blockchains with the highest Total Value Locked, Ethereum exhibits the largest decline with -8.23% over 7 days. Following suit, Arbitrum One, TRON, Solana, and BNB Smart Chain also experienced negative changes, indicating potential market corrections.

3. Kripto tirgus analīze

Kriptogrāfijas cenu un dominējošā stāvokļa analīze un lielāko ieguvumu un zaudētāju analīze ir divi galvenie kriptovalūtu tirgus analīzes faktori.

3.1. Crypto 7-D cenu izmaiņu un dominējošā stāvokļa analīze

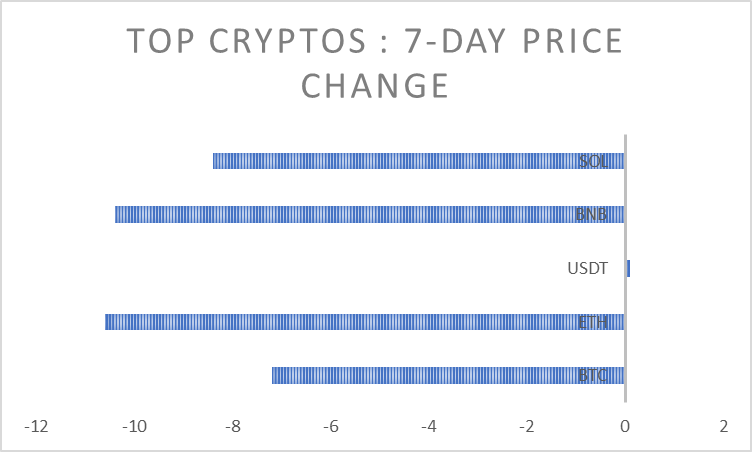

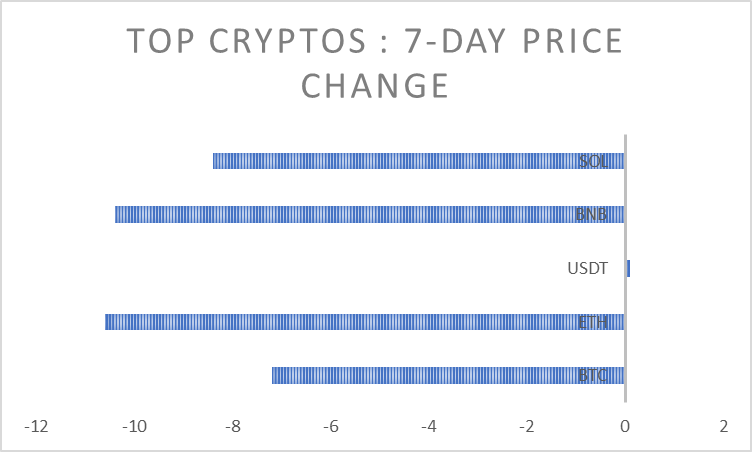

Bitcoin, Ethereum, Tether, BNB un Solana ir labākās kriptovalūtas atbilstoši tirgus ierobežojuma un dominējošā stāvokļa indeksiem. Analizēsim viņu septiņu dienu cenu izmaiņas.

| kriptonauda | Dominēšanas procents | 7. d — izmaiņas (%) | Сena | Tirgus Cap |

| BTC | 49.04% | -7.2% | $64,084.16 | $1,258,101,656,738 |

| ETH | 15.65% | -10.6% | $3,331.20 | $400,013,898,271 |

| USDT | 4.09% | + 0.1% | $1.00 | $104,192,005,600 |

| BNB | 3.32% | -10.4% | $550.28 | $84,836,562,746 |

| SOL | 3.02% | -8.4% | $172.49 | $76,505,792,215 |

| pārējie | 24.88% |

In the realm of top cryptocurrencies, ETH and BNB experienced significant declines of -10.6% and -10.4% respectively over 7 days. SOL and BTC also saw notable drops of -8.4% and -7.2% correspondingly. However, USDT showed minimal fluctuation with only a +0.1% change.

3.2. Nedēļas labākie ieguvēji un zaudētāji Kripto tirgū

Šeit ir saraksts ar nedēļas labākajiem ieguvējiem un zaudētājiem kriptovalūtu tirgū. Analīze tiek veikta, izmantojot 7 dienu pieauguma un 7 dienu zaudējuma indeksus.

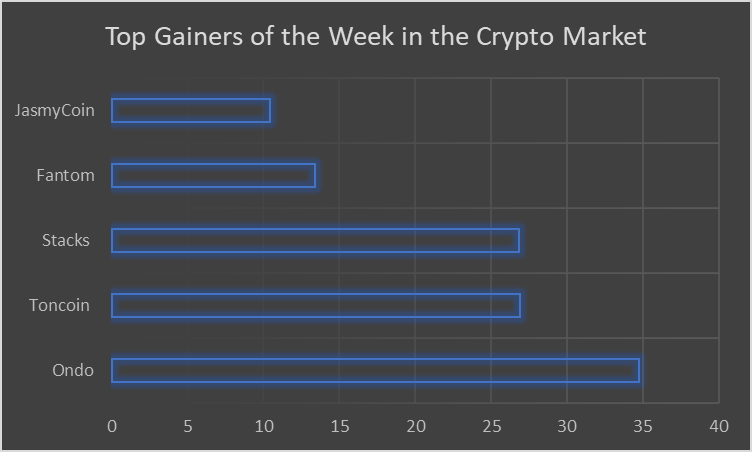

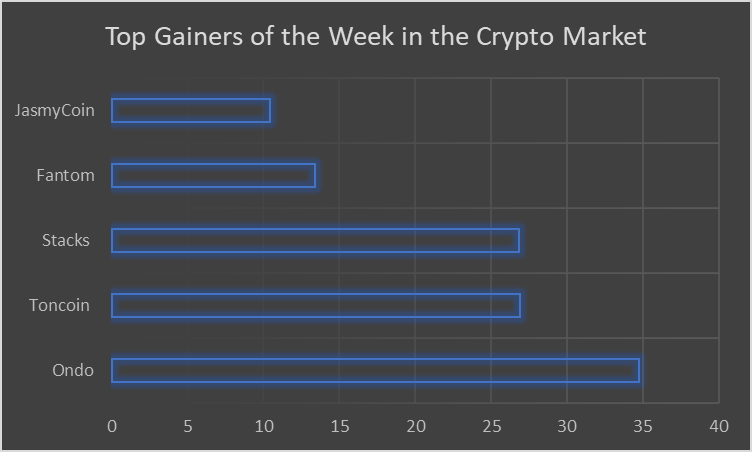

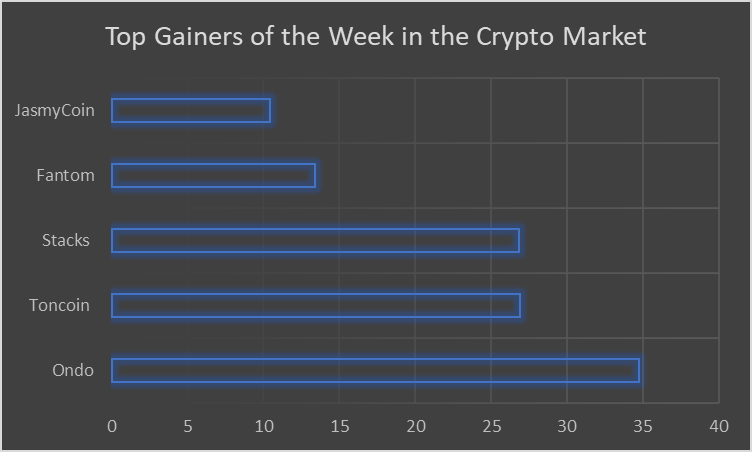

3.2.1. Nedēļas labākie ieguvēji kriptovalūtā

| kriptonauda | 7 dienu peļņa | Сena |

| Ondo | + 34.75% | $0.7029 |

| toncoin | + 26.89% | $4.79 |

| Skursteņi | + 26.83% | $3.53 |

| Fantom | + 13.38% | $1.09 |

| jasmikoīns | + 10.44% | $0.02071 |

In the crypto market, Ondo emerged as the top gainer of the week with a significant 34.75% increase, followed closely by Toncoin and Stacks at +26.89% and +26.83 respectively. Fantom and JasmyCoin also saw notable gains at +13.38% and +10.44%.

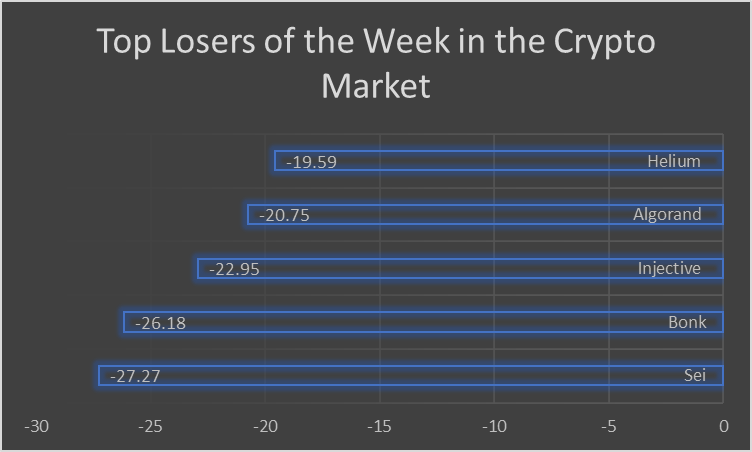

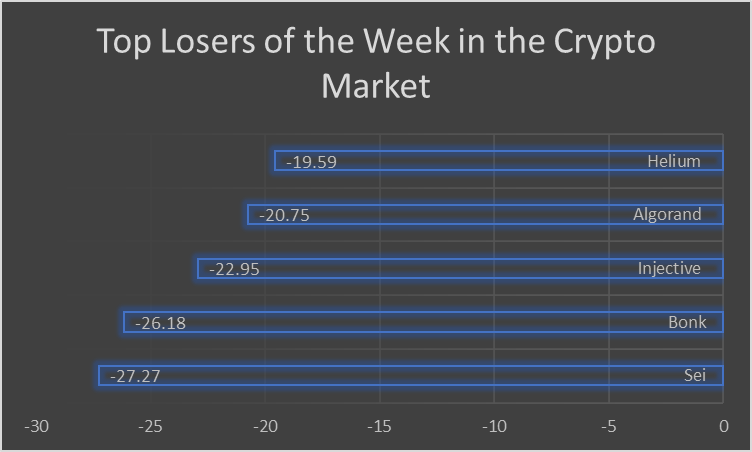

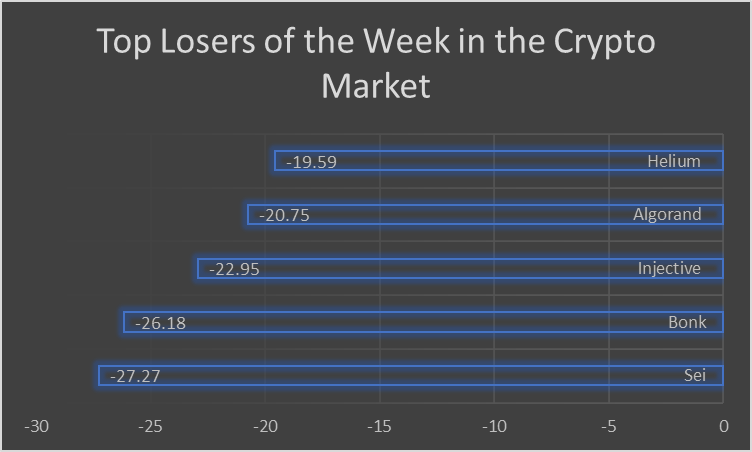

3.2.2. Nedēļas labākie zaudētāji kriptovalūtā

| kriptonauda | 7 dienu zaudējums | Сena |

| Sei | -27.27% | $0.8024 |

| Bonk | -26.18% | $0.00002225 |

| Injicējošs | -22.95% | $35.36 |

| Algorands | -20.75% | $0.241 |

| Hēlijs | -19.59% | $6.55 |

In the crypto market, Sei experienced the most significant loss of the week at -27.27%, followed closely by Bonk at -26.18%. Injective, Algorand, and Helium also saw notable declines at -22.95%, -20.75%, and -19.59%.

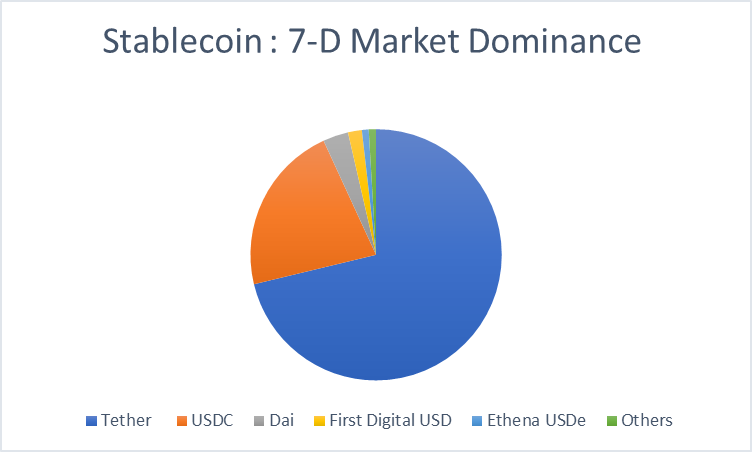

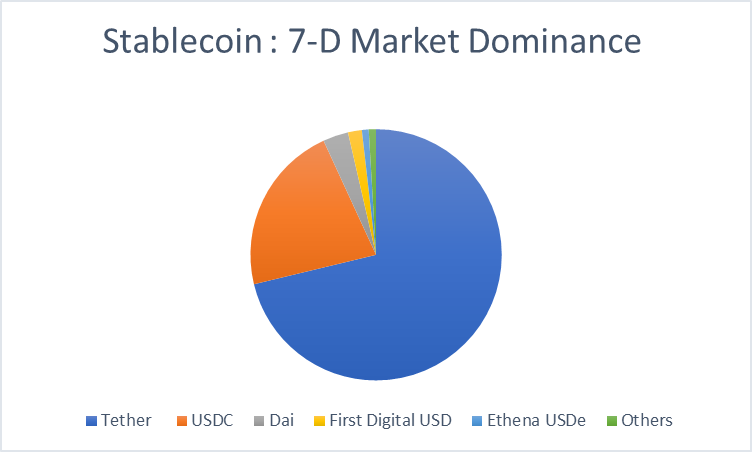

3.3. Stablecoin iknedēļas analīze

Tether, USDC, DAI, First Digital USD un Ethena USDe ir labākās stabilās monētas tirgū tirgus kapitalizācijas ziņā. Analizēsim viņu iknedēļas sniegumu, izmantojot septiņu dienu tirgus kapitalizācijas, tirgus dominēšanas un tirdzniecības apjoma indeksus.

| Stablecoins | Tirgus dominēšana (7 d) [%] | Tirgus kapitalizācija (7 d) | Tirdzniecības apjoms (7 d) | Tirgus kapitalizācija |

| Tether | 71.23% | $104,042,955,963 | $72,933,877,566 | $104,101,083,533 |

| USDC | 21.90% | $31,996,066,950 | $9,566,842,109 | $32,098,623,910 |

| Dai | 3.26% | $4,763,561,388 | $739,396,685 | $4,805,964,452 |

| Pirmais digitālais USD | 1.79% | $2,619,642,987 | $8,929,619,191 | $2,625,007,732 |

| Etēna USDe | 0.87% | $1,270,115,281 | $116,077,978 | $1,274,113,067 |

| pārējie | 0.94% |

Among stablecoins, Tether dominates the market with a significant 71.23% market share over 7 days, indicating its widespread adoption and trust among users. USDC follows with a 21.90% share, while Dai, First Digital USD, and Ethena USDe hold smaller portions of 3.26%, 1.79%, and 0.87% respectively. This dominance reflects Tether’s role as a leading stablecoin for traders.

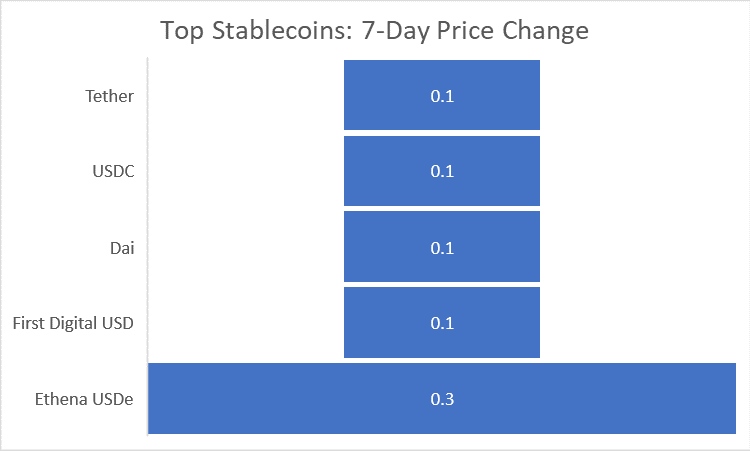

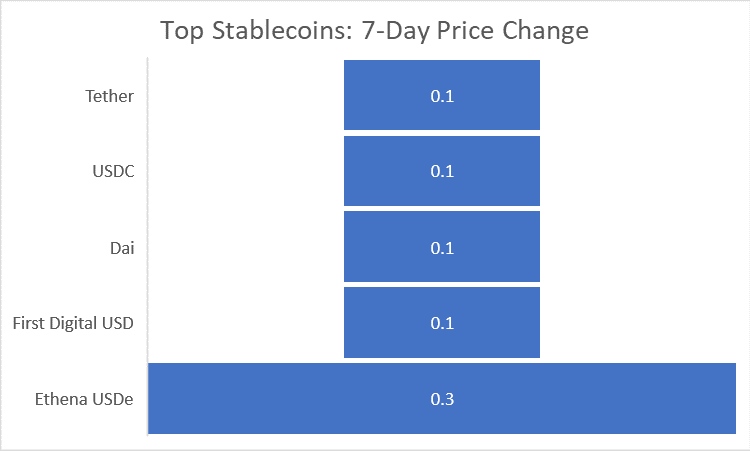

Tālāk analizēsim populārāko stabilo monētu iknedēļas veiktspēju, izmantojot septiņu dienu cenu izmaiņu indeksu.

| Stablecoins | 7 dienu cenas maiņa (%) | Сena |

| Tether | + 0.1% | $0.9995 |

| USDC | + 0.1% | $0.9995 |

| Dai | + 0.1% | $0.9986 |

| Pirmais digitālais USD | + 0.1% | $1.00 |

| Etēna USDe | + 0.3% | $0.9982 |

Among top stablecoins, Ethena USDe experienced the highest 7-day price change with a modest increase of +0.3%, followed by Tether, USDC, Dai, and First Digital USD, all showing a +0.1% change. These minimal fluctuations indicate stability in the prices of these stablecoins.

4. Bitcoin ETF iknedēļas analīze

Bitcoin Futures ETF un Bitcoin Spot ETF ir jāanalizē atsevišķi, lai iegūtu pareizo priekšstatu par Bitcoin ETF tirgu, jo tie pārstāv divus dažādus segmentus. Sāksim!

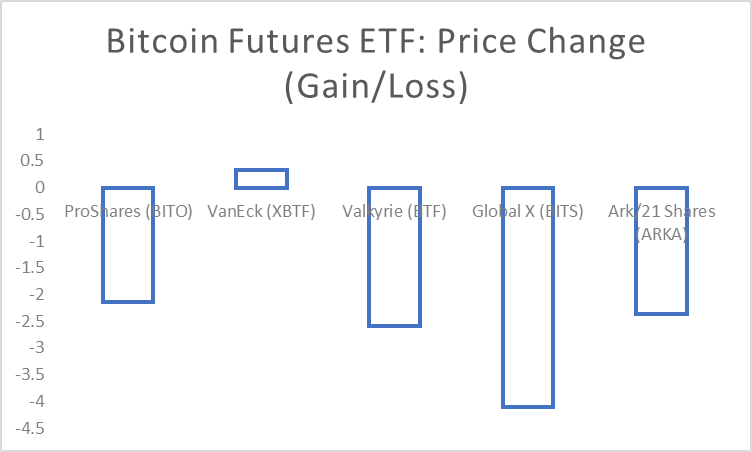

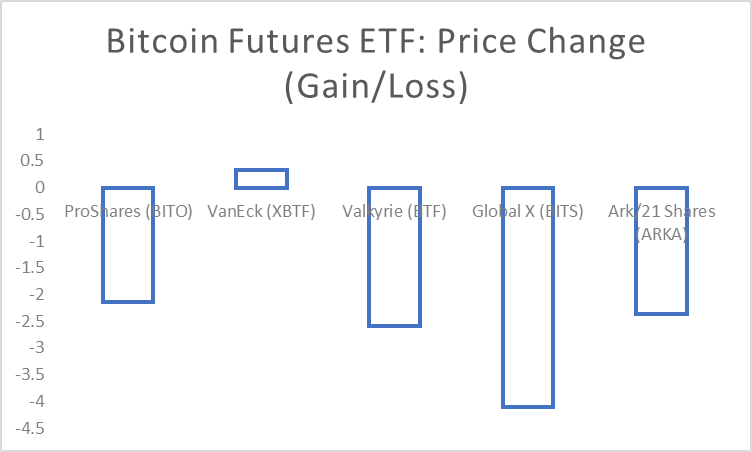

4.1. Bitcoin Futures ETF iknedēļas analīze

ProShares (BITO), VanEck (XBTF), Valkyrie (BTF), Global X (BITS) un Ark/21 Shares (ARKA) ir populārākie Bitcoin Future ETF saskaņā ar Asset Under Management indeksu. Lai analizētu šos ETF, izmantosim cenu izmaiņu procentuālo indeksu.

| Bitcoin Futures ETF | Cenas izmaiņas (pieaugums/zaudējums) [%] | Pārvaldībā esošs īpašums (miljardos) | Сena |

| ProShares (BITO) | -2.15% | $ 598.78M | $29.16 |

| VanEck (XBTF) | + 0.33% | $ 42.41M | $39.22 |

| Valkīrija (BTF) | -2.60% | $ 38.20M | $19.45 |

| Globālais X (BITS) | -4.10% | $ 26.10M | $67.12 |

| Ark/21 akcijas (ARKA) | -2.37% | $ 8.01M | $62.17 |

Among Bitcoin Futures ETFs, VanEck’s XBTF showed the highest gain with +0.33% over the period, indicating slight positive momentum. In contrast, Global X’s BITS experienced the largest loss at -4.10%, followed by Valkyrie’s BTF, Ark/21 Shares’s ARKA, and ProShares’s BITO, all posting negative change.

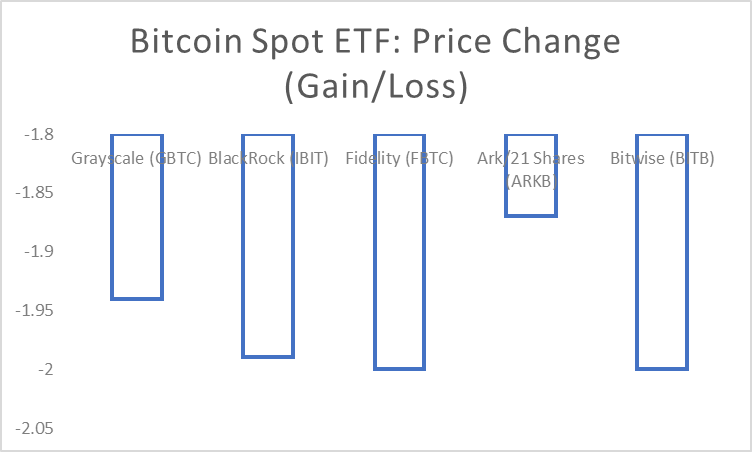

4.2. Bitcoin Spot ETF iknedēļas analīze

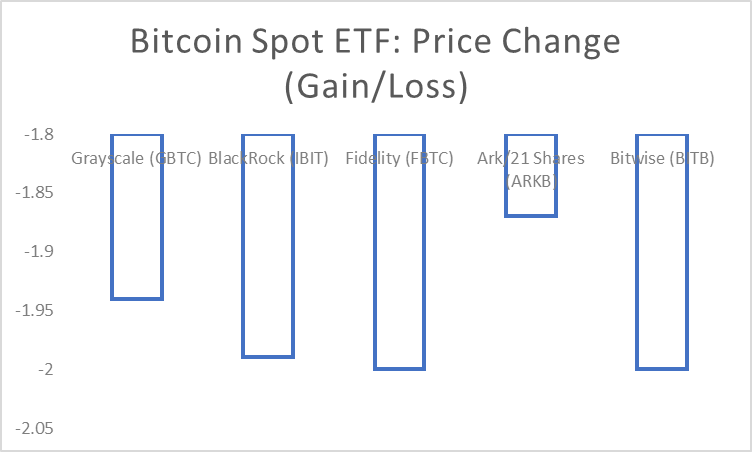

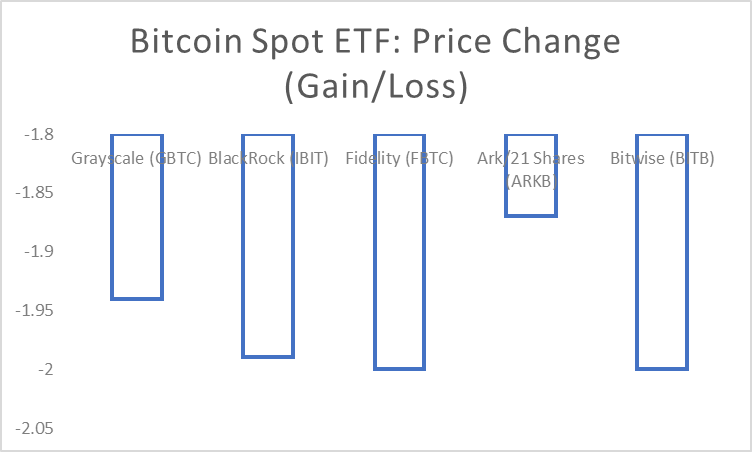

Pelēktoņu (GBTC), Blackrock (IBIT), Fidelity (FBTC), Ark/21 Shares (ARKB) un Bitwise (BITB) ir populārākie Bitcoin Spot ETF saskaņā ar Asset Under Management indeksu. Analizēsim tos, izmantojot cenu izmaiņu indeksu.

| Bitcoin Spot ETF | Cenas izmaiņas (pieaugums/zaudējums) [%] | Pārvaldībā esošs īpašums (miljardos) | Сena |

| Pelēktoņi (GBTC) | -1.94% | $ 27.68B | $56.98 |

| BlackRock (IBIT) | -1.99% | $ 15.85B | $36.41 |

| Fidelity (FBTC) | -2.00% | $ 8.85B | $55.91 |

| Ark/21 akcijas (ARKB) | -1.87% | $ 2.62B | $64.00 |

| Bitu veidā (BITB) | -2.00% | $ 1.96B | $34.84 |

In the Bitcoin Spot ETF category, Fidelity’s FBTC and Bitwise’s BITB both experienced a -2.00% decrease in price. BlackRock’s IBIT showed a slightly lower loss at -1.99%. Grayscale’s GBTC and Ark/21 Shares’s ARKB also show declines at -1.94% and -1.87% respectively.

5. DeFi tirgus iknedēļas statusa analīze

Lido, EigenLayer, AAVE, Maker, JustLend ir pieci populārākie DeFi protokoli, kuru pamatā ir TVL. Analizēsim tās iknedēļas veiktspēju, izmantojot 7d pārmaiņu indeksu.

| DeFi protokoli | 7 d izmaiņas (kopējā bloķētajā vērtībā) [%] | TVL |

| Lido | -11.01% | $ 32.701B |

| EigenLayer | -5.80% | $ 10.892B |

| SPĒKS | -7.29% | $ 10.494B |

| Maker | -9.19% | $ 8.392B |

| Vienkārši aizdod | -6.33% | $ 7.189B |

Over the past 7 days, DeFi protocols experienced declines in Total Value Locked. Lido and Maker saw the largest decrease at -11.01% and -9.19%, respectively, suggesting potential withdrawals or decreased activity. AAVE, JustLend, and EigenLayer also showed declines in TVL, indicating a possible shift in user funds within the DeFi ecosystem.

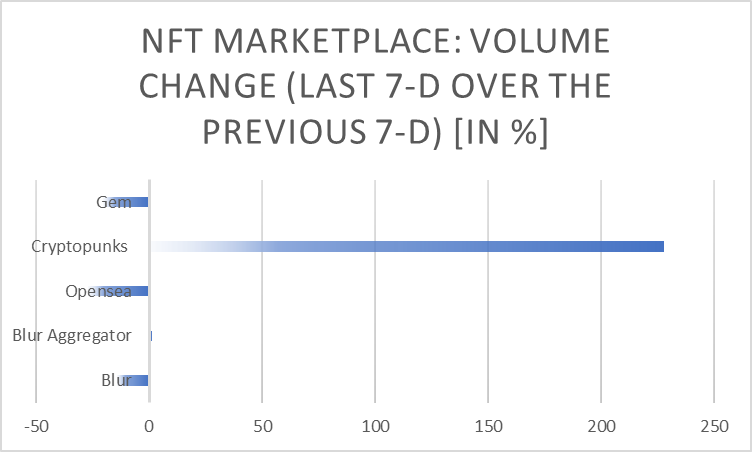

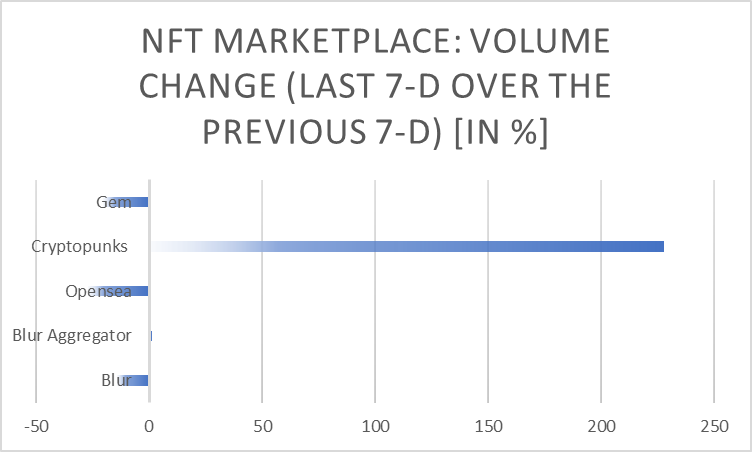

6. NFT Marketplace: pamata iknedēļas analīze

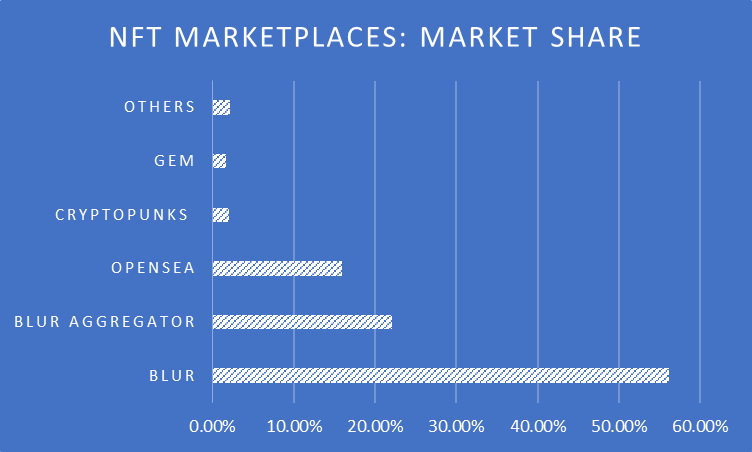

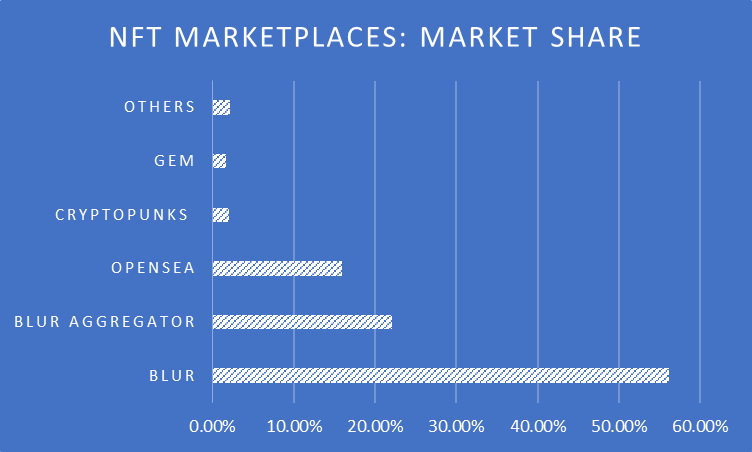

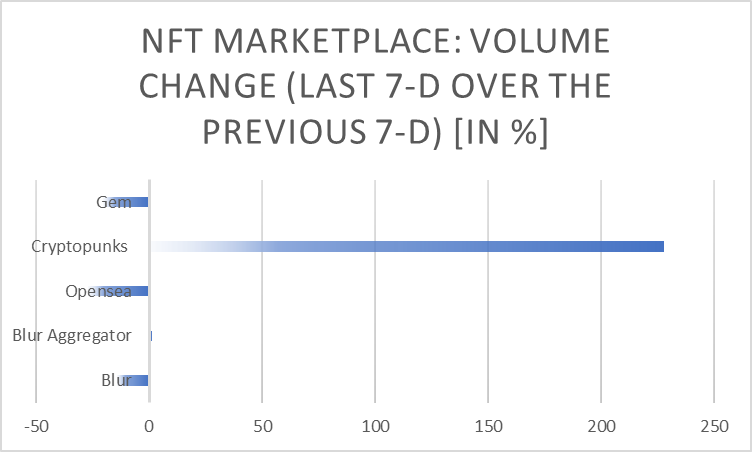

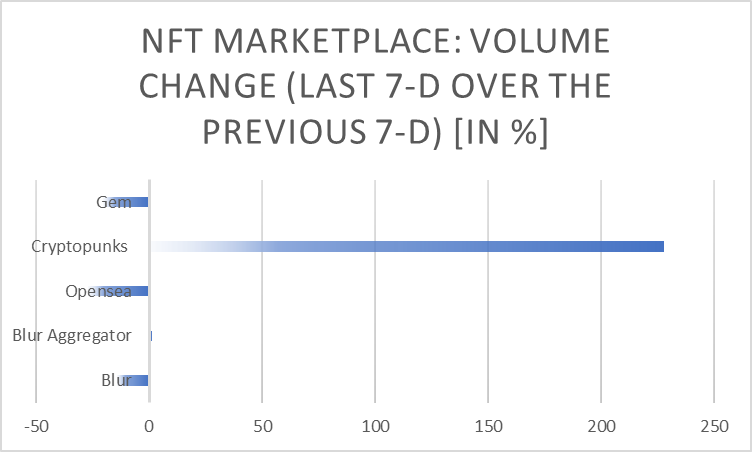

Blur, Blur Aggregator, Opensea, Cryptopunks, and Gem are the top NFT marketplaces on the basis of market share. Let’s analyse them using the Volume Change (change of last 7d volume over the previous 7d volume) index.

| NFT Marketplaces | Tirgus daļa | Skaļuma izmaiņas [pēdējās 7 dienas salīdzinājumā ar iepriekšējo 7 dienu apjomu] | 7 dienu ritošais apjoms | 7 dienu ritošā tirdzniecība |

| aizmiglot | 56.19% | -14.31% | 21198.54 | 33197 |

| Aizmiglojumu apkopotājs | 22.09% | + 1.20% | 11750.04 | 14868 |

| Atvērtā jūra | 15.97% | -27.13% | 6115.22 | 22155 |

| Kriptopunki | 1.98% | + 228% | 6128.92 | 25 |

| dārgakmens | 1.62% | -20.29% | 1217.31 | 3793 |

| pārējie | 2.149% |

In the NFT marketplace sector, Cryptopunks exhibited a significant surge in volume, with a remarkable +228% change over the previous 7 days, indicating heightened activity and interest. Conversely, Opensea, Gem and Blur experienced decrease in volume at -27.13%, -20.29%, and -14.31% respectively, suggesting a potential slowdown in trading activity.

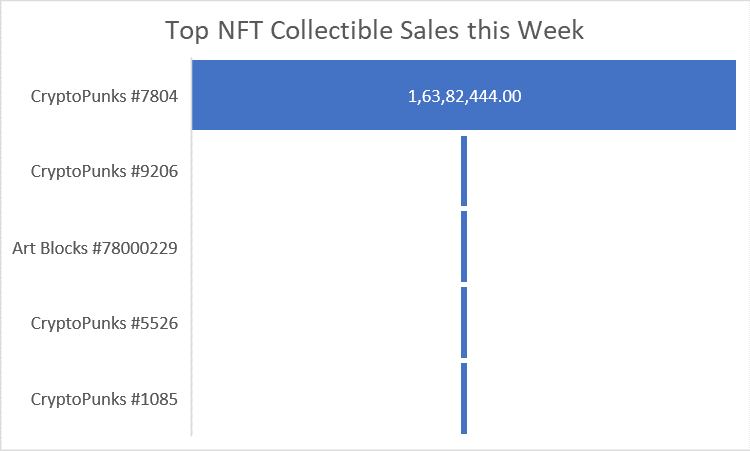

6.1. Šonedēļ visvairāk pārdotie NFT kolekcionējamie priekšmeti

CryptoPunks #7804, CryptoPunks #9206, Art Blocks #78000229, CryptoPunks #5526, and CryptoPunks #1085 are the top NFT collectable sales reported this week in the NFT market landscape.

| NFT kolekcionējamie priekšmeti | Cena (USD) |

| CryptoPunks #7804 | $16,382,444.00 |

| CryptoPunks #9206 | $226,990.00 |

| Mākslas bloki #78000229 | $220,357.62 |

| CryptoPunks #5526 | $216,732.47 |

| CryptoPunks #1085 | $215,497.58 |

This week’s top NFT collectible sales feature crypto CryptoPunks #7804 as the highest-priced item at $16,382,444.00, indicating strong demand and scarcity. Following, CryptoPunks #9206, Ark Blocks #78000229, and CryptoPunks #5526 and #1085 show significant prices. These sales highlight the continuing popularity of CryptoPunks collectibles.

7. Web3 iknedēļas finansējuma analīze

7.1. ICO ainava: iknedēļas pārskats

Oxya Origin, Bowled, Dappad, and Castle of Blackwater are the major ICOs that ended this week. Let’s analyse how much they have received.

| ICO | Saņēma | Žetona cena | Līdzekļu vākšanas mērķis | Kopējais žetonu skaits | Tokens (pieejams pārdošanai) |

| Oxya izcelsme | $2,310,000 | $0.02 | $330,000 | 1,000,000,000 | N / A |

| boulings | $3,430,000 | $0.07 | $400,000 | 500,000,000 | 19% |

| Dappad | $1,720,000 | $0.02 | $500,000 | 1,000,000,000 | 17% |

| Blekvoteras pils | N/Al | $0.1 | $200,000 | N / A | N / A |

Among the major ICOs ending this week, Bowled raised $3,430,000, Oxya Origin received $2,310,000, and Dappad collected $1,720,000. These amounts signify investor interest and potential funding for blockchain projects, indicating the market’s appetite for new digital assets and decentralised applications.

8. Iknedēļas Blockchain Hack analīze

As of March 23, 2024, hackers stole a massive $7.69 billion. Most of this, about $5.84 billion, was taken from decentralised finance platforms. Another $2.83 billion was stolen from bridges connecting different blockchain networks.

On March 8, 2024, Unizon lost around $2.1 million to hackers. On March 5, WOOFI was targeted, losing $8.5 million. Seneca lost $6.5 million on February 28, while Tectonica lost $0.25 million on February 22.

However, the biggest hit this year was taken by FixedFlot, which lost $26.1 million to a hacking attack.

Endnote

In this week’s comprehensive analysis of Web3, Blockchain and Crypto, we have brought out powerful insights that can be used to stay relevant to market developments. As the landscape evolves, the strategic integration of technology and data-driven decision-making becomes paramount for stakeholders navigating the dynamic realms of decentralised technologies.

Source: https://coinpedia.org/research-report/weekly-crypto-roundup-current-news-blockchain-trends-bitcoin-and-stablecoin-analysis-and-more-insights/